The diesel market in the United States is in the midst of its greatest crisis since the 1970s oil shocks. The diesel supply has been rapidly dwindling, driving inventory levels to levels not seen in 17 years. Since 2020, the U.S. national reserves have decreased by 43%. Many truckers are concerned about their livelihoods due to rising diesel costs and the threat of fuel restrictions.

Some areas of the United States have experienced more contraction than others. Stockpiles on the east coast have dropped to their lowest level since 1990. At the same time, inventories in the middle Atlantic area have fallen 78% since the outbreak began.

Rising fuel costs are frustrating for businesses of all shapes and sizes. High diesel prices combined with increased material and labor costs have led the inflation in the United States to a four-decade high. As a result, companies across the manufacturing and logistics industry continue to encounter problems. They struggle to find qualified employees and modify their financial sheets to match increased commodity prices.

According to the U.S. Energy Information Administration, the cost of heavy-duty vehicle fuel has risen by more than $1.50 per gallon in less than two months. The national average price of gasoline has been increased to $5.62 a gallon, a new high for the second week in a row. Prices in some areas have topped $6 as well.

Trucking, the most common mode of transportation for American businesses, accounted for 72% of all freight in 2019. Trucking firms apply a fuel surcharge to each load to cover higher fuel prices and ensure that they continue to make a profit. But, with diesel prices hitting record levels across the United States, it is putting a burden on trucking companies’ operations. It also impacts companies that rely on these trucking companies for logistics and wreaking havoc on their transportation budgets. Even with current labor constraints and the growing need to fulfill faster consumer shipping expectations, trucking companies find it harder to survive. Increased diesel costs also eat into transportation profits through post-delivery, empty-cargo “deadhead” miles, and other component expenses, increasing prices further.

The price of diesel fuel, vital for industrial operations, has continued to rise over the past few months. This has contributed to increased supply chain costs and inflationary pressures on all sectors, from house development to consumer product deliveries. These costs are particularly harsh on smaller trucking fleets, which make up most of the highly fragmented U.S. trucking sector. It is wreaking havoc on cash flows for companies that are typically undercapitalized and have a little buffer to absorb cost increases.

According to the American Trucking Associations, commercial vehicles in the United States use roughly 36.5 billion gallons of diesel yearly, and motor carriers spent about $111.6 billion on diesel fuel in 2019.

Fuel surcharges are typically included in contracts by trucking companies to compensate for rising diesel prices. However, the hundreds of smaller fleets and independent owner-operators who make up most of the highly fragmented truck sector will find it more difficult to pass on the additional costs as growing operational expenses are already squeezing operators. Adding to the damage, the base shipping prices on trucking’s spot markets are falling due to waning freight demand.

Implications for commodities

According to analysts, fuel costs on inflation might strike a dent in consumer spending if diesel prices continue high. It will impose significant expenses on shippers and transportation businesses. According to economist Anirban Basu, the increased cost of diesel fuel harms the U.S. economy’s near-term outlook and increases the risk of recession in 2023.

Fresh produce is often more of a spot rate industry, and fuel costs will significantly influence any of those smaller trucking firms. Rising diesel costs have had and continue to influence the whole fresh produce supply chain. According to the U.S. Department of Agriculture, the U.S. imported more than $15 billion in fresh food from Mexico in 2021. Logistics accounts for one-third to one-half of the cost of fresh produce. It’s easy to predict how rapidly changes in that expenditure category will affect the base price.

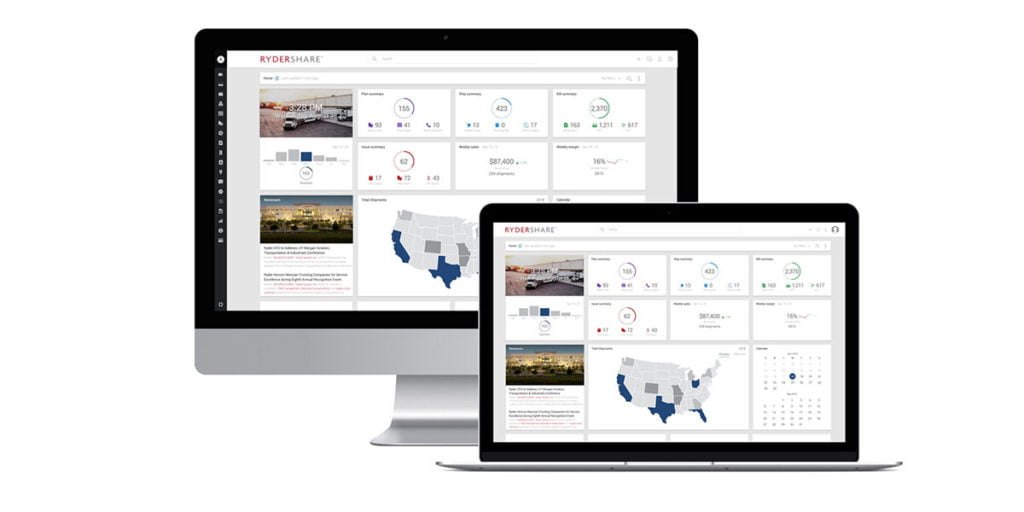

In the current high inflation environment, a company can contain the cost impact with an effective TMS. If you are looking for great Collaborative TMS solutions, Turvo is the right partner. Turvo provides the world’s leading Collaborative TMS application designed for the supply chain. Turvo connects people and organizations, allowing shippers, logistics providers, and carriers to unite their supply chains, deliver outstanding customer experiences, collaborate in real-time, and accelerate growth. The technology unifies all systems, internal and external, providing one end-to-end solution to execute all operations and analytics while eliminating redundant manual tasks and automating business processes. Turvo’s customers include some of the world’s most considerable Fortune 500 logistics service providers, shippers, and freight brokers. Turvo is based in the San Francisco Bay Area with offices in Dallas, Texas, and Hyderabad, India.