It’s easy for shippers, brokers, and third-party logistics providers (3PLs) to get lost in the freight data conversation. As explained by Peter Moore of Supply Chain 24/7, advancements in logistics technology and the opportunities to apply big freight data are finally approaching maturity and empowering whole new ways in which brokers, 3PLs, and shippers interact. The opportunities, to understand market conditions and increase profitability through analytics, are more apparent through the impact and analysis of data. “With global shipper organizations consistently changing supplier partners, markets, and customers, the logistics function cannot simply wait for a request for rates from the business unit before exploring the market. Instead, they should constantly be seeking opportunities for cost and service improvements through data mining and analytics or business intelligence.” So, what should they be tracking in the first place?

1. Spot Market Conditions

Everyone gets involved in the spot versus contracted freight discussion. It is an industry pastime. However, spot freight is ever-present. At some point, even carriers with established contracts and ample capacity need to tap into the reserve of spot market partners. At the same time, describing the market as a “pure” spot market, clouds the discussion. Brokers, 3PLs, and shippers need to track the availability of spot market carriers, the strain on resources, asset location and utilization, and more.

2. Freight Matching Data

Another critical aspect of freight data that brokers, shippers, and 3PLs should understand is derived from freight matching capabilities. Freight matching capabilities effectively use multiple load boards to help companies secure competitive rates and work together. Remember, in today’s age, collaboration is everything. Meanwhile, failures to collaborate lead to inefficiencies in the supply chain. Measuring the effectiveness of freight matching capabilities allows organizations to build better business cases for continued use of collaborative resources, including a single pane of glass for managing freight that enables end-to-end visibility.

3. Current Freight Status

Tracking current shipment status is another freight data point to consider. Current freight status may include in-transit, waiting for unloading, and more. It ultimately reflects any status of a shipment including what is occurring and what should happen to achieve the expected result. It also reveals the need for expected time of arrival (ETA) projections, allowing dock managers to better schedule appointments and prevent excess dwell time and detention charges.

4. Typical Costs for Shipments of Like Stature

Shippers, brokers, and 3PLs need to know the total costs for shipments of similar stature. In other words, shipments moving along similar trade lanes should have a projected and realistic cost. Analyzing this freight data for similar sized and routed shipments helps companies to improve their use of resources and lower operating expenses. Depending on the type of company, whether it’s a broker or a shipper, understanding the typical cost is essential to properly valuing its services.

5. Compliance Data for In-House Fleet Processes

Shippers, brokers, and third-party logistics providers may also operate in-house fleets. This aspect of supply chain management gives rise to new opportunities to collect and analyze freight data. Companies gain insights into vehicle condition, compliance with maintenance recommendations, and even HOS regulations. Essentially, better controls over the existing fleet and use of available resources translate into lower third-party expenses. These savings trickle down into better costs for the end-user, both shippers and customers.

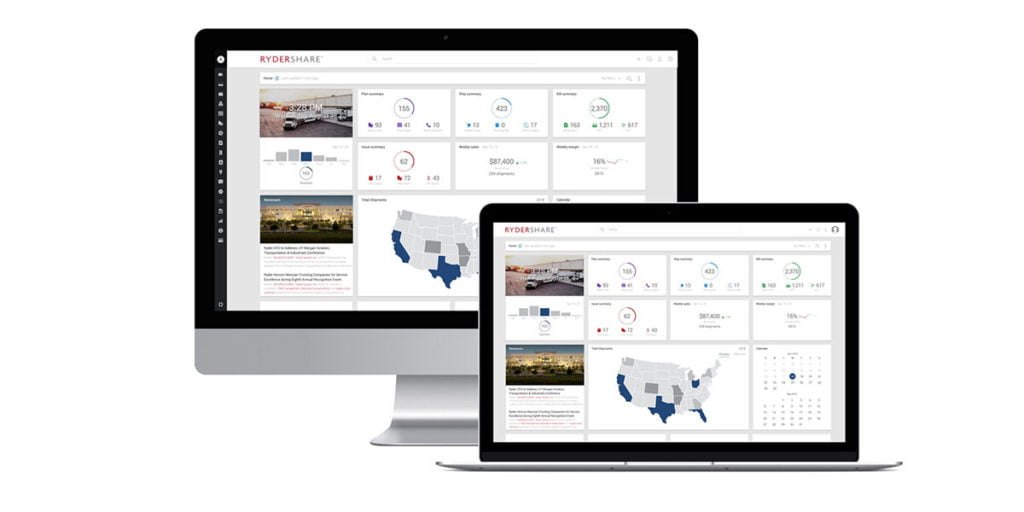

Start Tracking the Right Freight Data With a Collaborative Logistics Platform

Figuring out how to track the right freight data can be troublesome. In the modern world, the opportunity to generate and collect data continues to grow. Everything produces data. Not only is it far too immense to manage manually, but also manual data management is reminiscent of a hellscape. Promisingly, more organizations are turning to advanced technologies and connected systems to effectively automate the aggregation and application of freight data.

Visit Turvo online to learn how a unified supply chain systems tech stack is possible through our innovative logistics collaboration platform.